Month: November 2013

Lessons Learned – Session 9

This week we had a chance to practise our presentation for next week as both our teachers were away on business. Karina stepped in and asked us to present our business models and revenue streams to the class and provided us with loads of useful feedback for our presentation to the professors next week!

This weeks class was all about the key activities and key resources of our business. We had to really think about what the key activities our business would be undertaking and what we would need to make this happen. We discussed how the system has to be simple so that ordinary people can work it and achieve the goals set. To do this Karina discussed the use of processes in an organization and how they were vital to the efficient functioning of the company. These processes are a way to standardize and benchmark efficiency/quality/outcomes.

After carrying out exercises based on the process of our business we watched a really interesting video, that made us all realise that even though an activity may seem completely obvious and simple, we regularly forget to carry it out and often these are the most important activities. By forming check lists and processes these problems can be eradicated! The final part of the key activities section of the lecture was discussing value chains and to understand which parts of our business were they key parts and which were support activities.

After the break we discussed the key resources, so the organizational structure of the business, the roles played by the employees and their capabilities needed. We also discussed how it was better to hire employees with the right attitude as these people have a motivation for the job and to learn, than to hire someone with capability. This is because even though someone has the right capabilities for the job, if their attitude for the company or position is negative then it is extremely difficult to get integrate them into the company culture and to get the necessary results from them.

Partnerships were also discusses, we realised that we need to develop buyer-seller relationships to develop strategic supply and ensure that we gain a high quality low cost supply that meets our demand at all times.

Having learned all this, we now just need to put it all into practise for next weeks presentation and read the next pages of the required reading!

The presentation of week 10

This week we decided to change our presentation layout for a leaner and cleaner one – Please enjoy our best presentation so far!

The TempBox Processes

TempBox processes

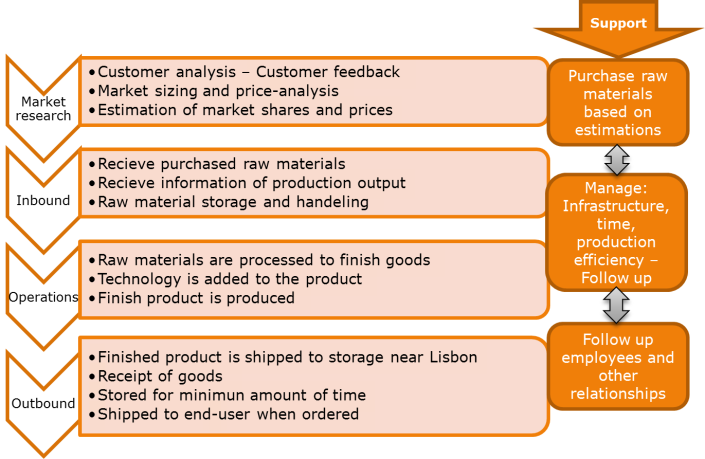

To complement the value chain we have broken it down in details into an overview of the processes that is happening from before we attract a customer to the time of delivery.

These processes are based on what we see ourselves doing the first years before integrating more of the activities vertically.

We do not however use the general value chain process. As we are a startup we have decided to do some changes to the structure in the value chain when it comes to processes.

As you can see we have chosen to have market research as the first element in the process, of course this is a continuous process, however we believe this to be at the very start of the production. Firstly, we are already today testing the market, doing research on it, market sizing, price calculations etc. without having started producing. Secondly, the TempBox, as a start-up, the first thing to figure out – Is there a problem that needs to be solved for the customers out there, and can we actually solve it?

The rest of the processes are rather straight forward and do not need much explanations. However on the right side we chose to add some of the most important support activities in the daily operations.

There is the procurement: purchasing materials for production, the infrastructure in the general which is management of the business like measuring performance indicators in outputs, infrastructure (IT and physical), efficiency, material usage, cycle times (time from order to shipped) etc. And also the human relations, if we want to hire people they need training, feedback, rewards, motivation and so on.

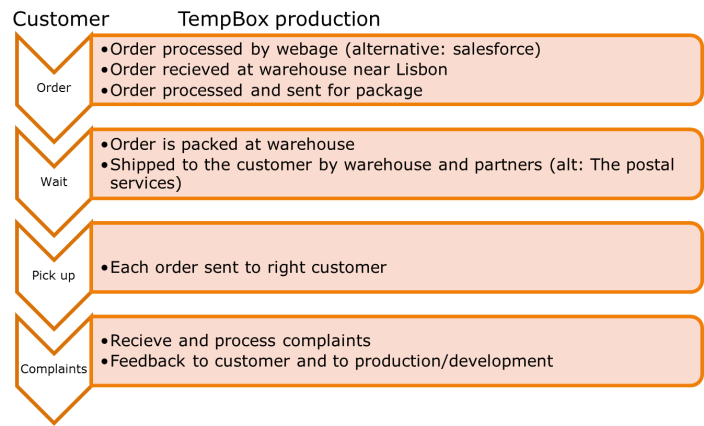

The Customer process

The customer process is broken down into an illustration of the process from ordering to receiving and perceiving the value received.

The value chain of the TempBox

First we want to present our vision and mission (At the time they are not separated as they need to be revised), and our strategic position.

The vision and the mission

«We want to change how people eat on the go – We will give people the freedom of choice, and the ability to save both money and time by providing them a box which keeps the food fresh, and can easily heat it up in several electrical output sockets»

The visions/mission is based (as it should be) on our initial idea of heating food for people on the go. We say we want to change it, not because no-one eats food from a lunch box today, but as we believe people deserve to be able to eat food that is delicious, despite it coming from a lunch box. We will give our customers the freedom of choice to eat whatever, wherever they want, and again of course, heat it up in several sockets!

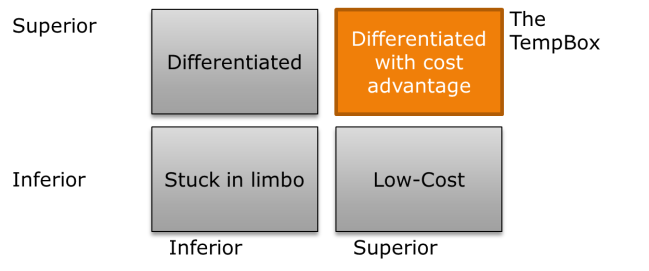

The strategic perspective

Our strategic position has changed from being low-cost to be a differentiated product – with a patent on the design and alternatively the technology, we will have the ability to take a great market share in the heat-able box industry market. At the same time, as we will come back to, we will over time work for obtaining economics of scale and focus on cost-saving at the same time as we deliver a sleek and stylish functional product with the ability to heat and, customer orientation and warrantee benefits. This is our strategic position:

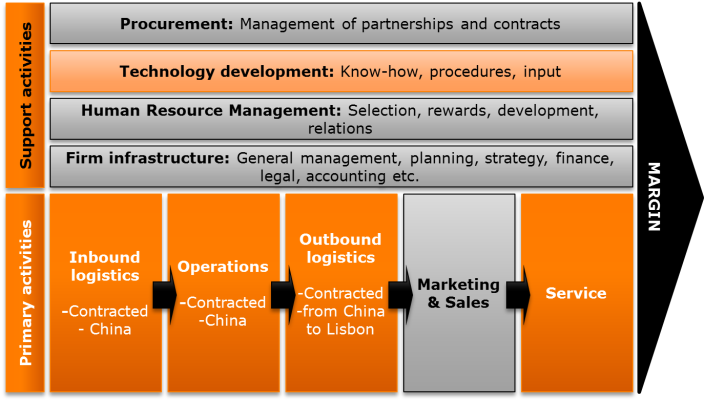

The value chain:

As we have a tangible product it makes more sense to us to have a value chain. To us, a value chain is the strategic management of cost positioning. The linkages and inter-relationships in the value chain is presented as a flow of activities which can, and will be optimized.

With the value chain, we are decomposing the activities of our firm into strategically important units (Stabell and Fjeldstad 1998). With this tool we can more easily see what is important for the TempBox to focus on in house, and what can and should be out contracted at this time.

We are initially the ones with the idea. We will contract most of our key activities – however our value chain is presented with the primary activities in it. We have done this to illustrate how our value chain looks like when you link all the activities that are contracted out together.

We have made the choice to contract out our key activities as this is consistent with our vision and long term strategic objective – We want to be the idea, the brain behind the project. We want to focus on our core competence which is the ideas, market research, customer orientation, partnership management and management and coordination in the company. When we learn more about the industry, production etc. we might consider demolishing some of the contracts and have logistics and production ourselves. We believe that with learning and time we will be able to take most parts of the value chain in house and operationalize and smooth the process so that it will be less costly than managing and paying for the contracted businesses which we do not control and have to depend on.

This is our resulting value chain, the grey we will do ourselves, the rest we will contract out, mostly to China.

Inbound logistics: material handling and warehousing – We will not do this: contracted. We have sourced materials and productions in China, therefore all raw materials and handling will be dealt with in China. The product will then be shipped to Lisbon via Garland and dealt with in-house.

Operations: transforming material to the final product – outsourced to production companies in China

Outbound logistics: Order processing and distribution – The final product will be storing in an internal warehouse ready to be shipped to the end consumer. Products will enter the warehouse via an IT system, nothing will enter or leave the warehouse without being registered by the system. Products will be boxed by the warehouse and prepared for distribution. Once the product is prepared the delivery to the end consumer will be outsourced to delivery experts UPS or DHL. Outbound logistics will also include supply and demand planning to ensure that stocks are always at the appropriate levels. This will be done in-house by the warehouse manager who will use the IT system and analyse trends and past data to secure the optimal level of inventory.

Marketing services: We will carry out the marketing services ourselves, however as we grow there is a possibility that this could be partly outsourced (i.e. large scale marketing to India). The marketing services involves market research for estimation of demand which we have already estimated for the first year, however it is a continuous process. Here we will generate demand through the use of marketing tools (this process involves creating awareness through internet-based free tools which has already commenced (numbers will come later)), we will manage our channels through this which is closely aligned with partnerships (we will talk about this later). This box is also about communication with clients, refining the product etc. Hence as this part is our core competence together with the management of all partnerships, we will do this ourselves.

The support activities

We will be carrying out the support activities ourselves. This is where our main business lies. Procurement and management of partnerships will be done by us. It will involving liaising closely with supplier to secure appropriate materials at the best costs, we will come back to this point later in the presentation.

Technology is a lighter shade of orange due to the fact that we are not engineers and we have to partly outsource the technology development. However we will play a role in the development and improvements on the product. Through the feedback of our customers, market research, kinks and problems, we will learn and develop the product further.

Cost and value drivers in the value chain

The cost drivers in the value chain of the TempBox are highly linked to the fact that we are contracting out most our business. We do not have scale advantages, but this will highly influence us in the future as we have one product and a very narrow scope, also we will be larger and better. Highly intertwined with scale are the Linkages and Inter-relationship. At the time we do not believe our value configuration to be optimal due to contracting out most of the primary activities.

Reference:

Stabell, C. B. and Ø. D. Fjeldstad (1998). “Configuring value for competitive advantage: on chains, shops, and networks.” Strategic management journal 19(5): 413-437.

Aside Posted on

This week we have really considered the design of the product! I have had to make sure it’s technically doable and source all the components of the product, to do this the power, electricity, reliability and safety of the product were all considered to find the right components and put it together.

The first step was to draw up the product and then it was designed in 3D on photoshop to create a ‘prototype’ design. I then had to find a producer of a silicone flexible rubber mat that would heat to around 180 degrees, this caused many problems as the multi-plugability had to be considered next and we found that a USB cable could not be used to heat the product as it would not transmit a high enough current to power the matt. To be able to power this we had to source AC/DC adapters with a 240v input/24v output and car chargers that have the same output and an ability to withstand the heat. Below you can see out prototype!

The base of the box is both collapsible and flexible so that it takes up minimal space when out of use, the inside is coated with an insulator to keep your food fresh and warm for as long as possible! Whilst the lid is a super elastic stretchy silicon to adapt to the size of your food and keep it securely in place.

To cost it, we source each component in quantities to create 1000 units each. We then added all the shipping costs (i.e. Air Rate, Fuel Tax, Insurance, Document Validation and Delivery).

These total costs came to 12.85 euros per item! Once we had this figure, I created a pricing model, including the margins necessary for all parties involved, and with this I understood that with the price we are charging (decided by the customers through surveys and landing pages) we did not have a large enough margin to allow us to sell through a distributor. Therefore we shall sell our product through our website and directly to retailers. We are however able to maintain the industry standard of a 30% margin, which is great!

By the end of the week the pricing model should be fully in tact and posted on the blog! Check back later to find an uploaded excel document of all the costing and pricing decisions!

Hypothesis validations: Surveys and A/B testing results

Hey guys! In the tables below is a recap of all the most important hypothesis (the ones that get the highest scores)that we had to validate. The first two tables of hypothesis could be done in the 2 upcoming weeks. The last table will be more difficult and we will only have an answer to them towards the end of the project. But in the meantime, we already did 2 surveys that brought us a lot of answers to our hypothesis. All the answers will be summarized in an upcoming post!

Hypothesis tables:

TABLE 1

Attention: We are still waiting for more reliable results for the landing pages, we already have 243 views and collecting more views on the other landing pages.The results will be uploaded soon.

| Hypothesis (A/B testing) | Conv.Rate With (A) | Conv.Rate Without (B) | Results | Who is doing it ? (Name) |

| Heatable influence buy decision | N/A | N/A | See Ulvin’s Survey | Manuel |

| Stylish influence buy decision | N/A | N/A | See Ulvin’s Survey | Manuel |

| Multi-Plug influence buy decision | N/A | N/A | See Ulvin’s Survey | Erick |

| How much willing to pay? | TBD | TBD | Result coming | Erick |

NB:

The heatability and plugability of the product has been already tested in the surveys below, so it is actually not necessary to test it another time in A/B testing.

Concerning the price of the TempBox, in addition to the A/B testing; we also added two question in the Ulvin’s survey (one open question allows people to evaluate freely the price of the product) to have an idea on what range of price we should do. Based on the costing calculations done by charlotte (see other post in this page), and the results from the survey, we expect the price to be around 30 euros = see results from costing and from survey in TABLE 2. However, we still need to know if the price influences the buying decision in itself, so we still need to wait until we have the results from the A/B testing.

TABLE 2

| Hypothesis (surveys) | Testing | Validation | Results | Who is doing it ? (Name) |

| Many workers & student face a lack of food choice | Survey(Post link to survey) | >75% agree | we have 67,74% agreed for the moment. | Ulvin’s survey |

| “the tempbox is a convenient product” | Survey(Post link to survey) | >80% agree | YES =(more information below) | Ulvin’s survey |

| People on the go appreciate the ability to bring their own food | Survey(Post link to survey) | >60% agree | YES (more informations below) | Erick’s survey |

| Heatability influence buy decision | Survey | >70% agree | >80% = more than expected | Erick’s & Ulvin’s survey |

| Price the customer is willing to pay | Survey | 25/35 euros | sum of evaluations 757/ 30 evaluations= 25,2333 euros1/3 evaluate it > 25 euros

almost 3/4 evaluate it <=25 euros |

Ulvin |

These Hypothesis have been tested this week thanks to our surveys, you can take it at the 2 links below:

Ulvin’s survey: https://www.surveymonkey.com/s/6KV5R7W

Erick’s survey: https://www.surveymonkey.com/s/27XNW6Y

Analysis of results from the survey:

1) Ulvin’s survey:

- First hypothesis : ‘Many workers & students face a lack of food choice‘

Conclusion: So here we clearly see that people have difficulty finding the food they really want to eat at their workplace. In fact, about 67,74% of the people that took the survey are not really satisfied with what they find to eat at their workplace.

2. Second Hypothesis: ‘the tempbox is a convenient product’

We tried to test this hypothesis by asking the 3 following questions on our surveys:

- What do you like most about our product? (open question)

For this one we had more than 1/3 people answering for heatability and 1/3 for design and the rest in plugability (which is almost the same as heatability, it just the way to heat the box)and the rest for the Design. So we can see here that people are really attracted by the heatibility function and the design. We can verify this looking at the 3rd question asked in this same section.

- What do you dislike most about our product? (open question)

Here we had a lot of concern about the reliability of the product, so we decided to change our business model and add a specific warranty and also we would ask for a european certification of conformity. This will ensure that the customer has no doubt on the reliability of the product.

We also get a significant number of answers on the size of the product. But this is partly balanced by the fact that people showed a lot of interest in the design, in the first question.

- Which of the following features of this product makes you want to purchase it? (Design, Heatablity, Multiplugability, Money saved, Time saved, Other (to specify))

The conclusion here is that, overall the porduct is convenient because of its design, heatability feature and also its design. Also, the last graph answers the latest hypothesis in the TABLE 2, which is :

3. third hypothesis: ‘Heatability influences the purchase decision’

Just like said above, we found in the surveys that the heatability is the most important feature for the customers. This means that we need to work on this part of the product to make it really reliable and really practical. This is our opportunity to enter the market of lunch boxes, and this will give us a first mover advantage.

In conclusion, the Heatability will dramatically attract a large amount of customer to buy the product (both customer coming from lunch boxes and new customers that havn’t use lunchboxes).

2) Erick’s survey

This survey is principally dedicated to the last hypothesis of the TABLE 2 which is the following : ‘people on the go appreciate the ability to bring food from home’. But there is of course some interesting information that can help us to know better the habits of the people.

RESULTS TABLE COMING THIS EVENING

TABLE 3

This table below shows the hypothesis that can’t be tested with A/B testing or with surveys. Those hypotheses results will be posted/updated towards the end of the project specially because of the nature of the hypotheses:

| Other Hypothesis | Testing | Validation | Results |

| Pop up shops/street sales increase awareness | See sales of similar products/researchws concern

Survey shows concern for safety and reliability. Conclusions from survey and interviews shows that this is not a low cost product. Street sales does not match our strategy |

Attract significant attention on street | Removed from the business plan:

Conclusions from survey and interviews shows that this is not a low cost product. Street sales does not match our strategy |

| We are able to raise financial resources | Pitch => at the end we will validate this assumption | Qualitative | Answer after pitch to investors |

| Different markets have same problems that can be solved by the TempBox | Data Collection/empirical Data | TBD | TBD |

These results were very helpful to create our business model canvas 2.0. It allowed us to realize what is the customer demanding for, and how should we change components of our business model in order to be as close to the customer needs, for example by changing our value proposition. In fact, we decided to focus our attention more on the important features of the product, so we removed the ‘freedom of choice’ from the canvas. We also put more emphasis on the ‘warranty’ and the ‘european certification of conformity’. Finally, we learned more about the price the customer is willing to pay.

Check out our webshop – The TempBox!

Link Posted on Updated on

Lessons learned in session 8

The focus of this session was on the revenue streams:

One can say that a direct revenue stream show that you actually have customers.

The direct streams are: Transactions, usage, renting, subscription, pre-pay, freemeium ( free + premium), and pay-per-use which are the normal customer sales. In addition we have intermediation (Selling other firms stuff on your webpage for instance), and advertisement, which do not involve the sale of the product.

The indirect streams can be renting out your excess capacity or sales by referrals by others.

REVENUE STREAM EXERCISE:

As always we did an exercise which ha importance for our business model and idea. We did a rather quick analysis of what our main revenue streams will be, and these are the ones we decided on:

– Transactions: We might sell the Tempbox through channels like our webshop and through retail stores. With time it might develop to be a box in different colors and shapes, and it can be sold with or without the plugs for heating.

– Intermediation: We are considering intermediation in our webshop. For instance we might sell books and accessories which complement a lunchbox like cooking books or preparation tools.

– Advertisement: We have a webshop and an internet community and will use some space on it for advertisement.

– Licensing: We might consider selling the license to the box to other firms in markets we are not able to, or willing to serve ourselves due to costs, uncertainty, too little knowledge of the market etc.

We also calculated the streams in price and quantity for the different streams, however, the numbers we got have to be done again, and we will post them when we have!

PRICING MODELS

What are the pricing models?

– Cost based: Cost + Margin à is not focused on the client

– Value based: Price based on the perception of the client. Can be used for high valued products or services. Not based on the cost of the resources à Depending on the value the clients gives the product.

– Competitive: You set your price close to the competitors because you are not too different. To high no-one buy, too low no-one buy

– Volume: price set to sell in a bigger quantity à Cost saving

– Portfolio price: Bundling services together, different products etc.

– Shaver price: The machine is sold at a low price, and then the cost of usage like the cartridge for a printer, is very high.

– Feature pricing: adding features like our customization increase the price – we can let them customize their own designs, share them with each other in the community.

THE MINIMUN VIABLE PRODUCT –MVP 3

In previous sessions and group-work we have been through the MVP 1 & 2, now it is time for 3. The MVP is a version of the product which gives the team the opportunity to collect the maximum amount of validated learning about the customers with the least effort.

We have decided to make a 3D design version of the product. We could make a box with a plug in it, but it would not represent very important features to our product like the design and flexibility. Hence, the 3D version will be the best MVP for us. With this version we will set up a fake sale and build a new landingpage to test the viability.

Thank you for reading, and until later!