The value chain of the TempBox

First we want to present our vision and mission (At the time they are not separated as they need to be revised), and our strategic position.

The vision and the mission

«We want to change how people eat on the go – We will give people the freedom of choice, and the ability to save both money and time by providing them a box which keeps the food fresh, and can easily heat it up in several electrical output sockets»

The visions/mission is based (as it should be) on our initial idea of heating food for people on the go. We say we want to change it, not because no-one eats food from a lunch box today, but as we believe people deserve to be able to eat food that is delicious, despite it coming from a lunch box. We will give our customers the freedom of choice to eat whatever, wherever they want, and again of course, heat it up in several sockets!

The strategic perspective

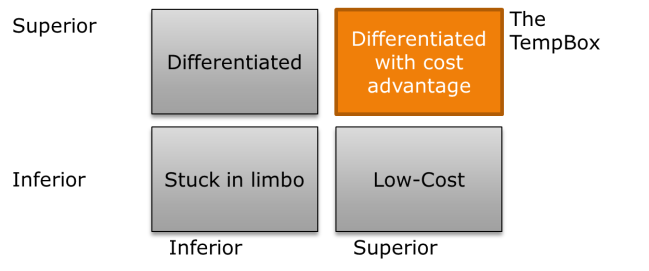

Our strategic position has changed from being low-cost to be a differentiated product – with a patent on the design and alternatively the technology, we will have the ability to take a great market share in the heat-able box industry market. At the same time, as we will come back to, we will over time work for obtaining economics of scale and focus on cost-saving at the same time as we deliver a sleek and stylish functional product with the ability to heat and, customer orientation and warrantee benefits. This is our strategic position:

The value chain:

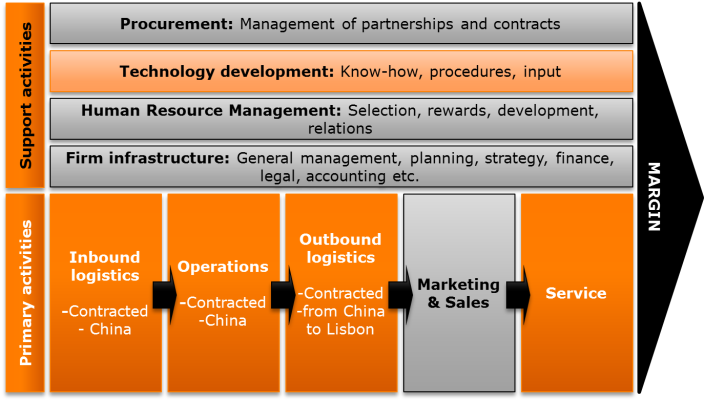

As we have a tangible product it makes more sense to us to have a value chain. To us, a value chain is the strategic management of cost positioning. The linkages and inter-relationships in the value chain is presented as a flow of activities which can, and will be optimized.

With the value chain, we are decomposing the activities of our firm into strategically important units (Stabell and Fjeldstad 1998). With this tool we can more easily see what is important for the TempBox to focus on in house, and what can and should be out contracted at this time.

We are initially the ones with the idea. We will contract most of our key activities – however our value chain is presented with the primary activities in it. We have done this to illustrate how our value chain looks like when you link all the activities that are contracted out together.

We have made the choice to contract out our key activities as this is consistent with our vision and long term strategic objective – We want to be the idea, the brain behind the project. We want to focus on our core competence which is the ideas, market research, customer orientation, partnership management and management and coordination in the company. When we learn more about the industry, production etc. we might consider demolishing some of the contracts and have logistics and production ourselves. We believe that with learning and time we will be able to take most parts of the value chain in house and operationalize and smooth the process so that it will be less costly than managing and paying for the contracted businesses which we do not control and have to depend on.

This is our resulting value chain, the grey we will do ourselves, the rest we will contract out, mostly to China.

Inbound logistics: material handling and warehousing – We will not do this: contracted. We have sourced materials and productions in China, therefore all raw materials and handling will be dealt with in China. The product will then be shipped to Lisbon via Garland and dealt with in-house.

Operations: transforming material to the final product – outsourced to production companies in China

Outbound logistics: Order processing and distribution – The final product will be storing in an internal warehouse ready to be shipped to the end consumer. Products will enter the warehouse via an IT system, nothing will enter or leave the warehouse without being registered by the system. Products will be boxed by the warehouse and prepared for distribution. Once the product is prepared the delivery to the end consumer will be outsourced to delivery experts UPS or DHL. Outbound logistics will also include supply and demand planning to ensure that stocks are always at the appropriate levels. This will be done in-house by the warehouse manager who will use the IT system and analyse trends and past data to secure the optimal level of inventory.

Marketing services: We will carry out the marketing services ourselves, however as we grow there is a possibility that this could be partly outsourced (i.e. large scale marketing to India). The marketing services involves market research for estimation of demand which we have already estimated for the first year, however it is a continuous process. Here we will generate demand through the use of marketing tools (this process involves creating awareness through internet-based free tools which has already commenced (numbers will come later)), we will manage our channels through this which is closely aligned with partnerships (we will talk about this later). This box is also about communication with clients, refining the product etc. Hence as this part is our core competence together with the management of all partnerships, we will do this ourselves.

The support activities

We will be carrying out the support activities ourselves. This is where our main business lies. Procurement and management of partnerships will be done by us. It will involving liaising closely with supplier to secure appropriate materials at the best costs, we will come back to this point later in the presentation.

Technology is a lighter shade of orange due to the fact that we are not engineers and we have to partly outsource the technology development. However we will play a role in the development and improvements on the product. Through the feedback of our customers, market research, kinks and problems, we will learn and develop the product further.

Cost and value drivers in the value chain

The cost drivers in the value chain of the TempBox are highly linked to the fact that we are contracting out most our business. We do not have scale advantages, but this will highly influence us in the future as we have one product and a very narrow scope, also we will be larger and better. Highly intertwined with scale are the Linkages and Inter-relationship. At the time we do not believe our value configuration to be optimal due to contracting out most of the primary activities.

Reference:

Stabell, C. B. and Ø. D. Fjeldstad (1998). “Configuring value for competitive advantage: on chains, shops, and networks.” Strategic management journal 19(5): 413-437.